- Contact Us for a Free Consultation 515-267-1265

When a marriage begins to break down, one of the first questions many people ask is whether they should vacate...

After separation or divorce, parents eventually begin rebuilding their personal lives. New relationships are a natural part of that process....

Family law disputes are emotionally charged. When relationships break down, disagreements about custody, parenting time, finances, or property can escalate...

A great experience with a lawyer, and fairly cheap too. He will always give you all the options, talk you threw the options, and will tell you some odds. He explains any question and doesn’t seem to be bothered by it. The easiest time I had with a lawyer ever. Highly Highly recommend.

I hired Jeremy for my child custody case. He is incredibly knowledgeable but also speaks to you in a way that’s very direct and easy to understand. He was very thorough and always responded quickly. He showed up to trial extremely prepared and always did a good job of helping put my mind at ease. I would absolutely recommend him, and I’ll hire him again in a heartbeat if I ever need anything else.

Jeremy is absolutely amazing!!! Very professional and does a great job of explaining processes. He has done a great job handling all of our family needs!!! High recommend Feitelson Law Firm!!!

Spousal support—often referred to as alimony—is one of the most challenging and emotionally sensitive aspects of any divorce. Whether you’re the spouse requesting support or being asked to pay it, concerns about fairness, financial stability, and long-term outcomes can significantly stress an already complex process. Unlike child support, which follows strict guidelines, spousal support is far more discretionary, making skilled legal guidance essential.

At Feitelson Law Firm, our Des Moines spousal support attorney provides clear, honest, and strategic representation to individuals on both sides of alimony cases. With over 20 years of family law experience in Iowa, we help clients understand their rights, evaluate their financial needs or obligations, and reach agreements or litigate outcomes that promote fairness and security.

Whether your divorce involves a short marriage, a long-term financial dependency, or a dramatic shift in income, we’ll walk you through the process with professionalism, empathy, and an unwavering commitment to your best interests, starting with an initial consultation.

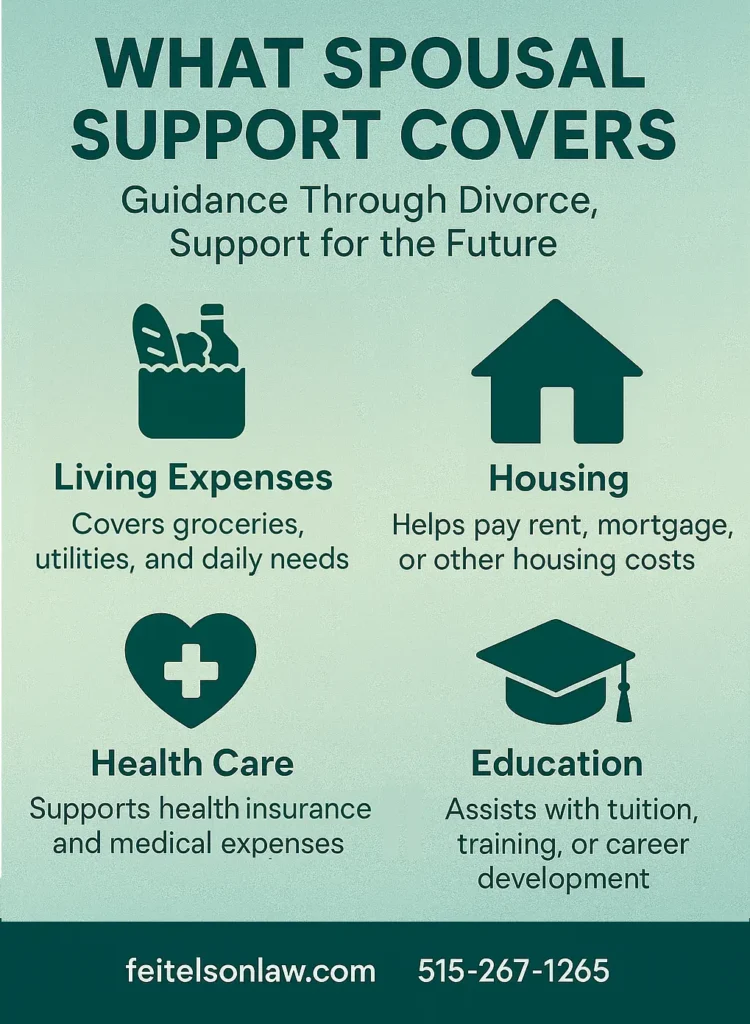

Spousal support, or alimony, is financial assistance that one spouse may be ordered to pay the other following a divorce. Its purpose is to help the receiving spouse maintain a standard of living reasonably comparable to what was established during the marriage—or to allow time and resources for the spouse to become self-sufficient.

Spousal support is not guaranteed in every divorce. Instead, Iowa courts evaluate various factors to determine whether it should be awarded, how much should be paid, and how long payments should last.

There are several types of spousal support in Iowa:

Our Des Moines spousal support attorney will help you assess which type of support may apply in your case and develop a strategy tailored to your financial goals and plans.

Unlike child support, Iowa does not use a fixed formula to determine spousal support. Instead, the court considers multiple factors to assess whether support is appropriate and, if so, how much should be paid and for how long.

The factors considered by the court include:

Every situation is different. Our role is to help you present a complete and persuasive case—whether you request or oppose spousal support—starting with a free consultation.

In Iowa, spousal support orders are often modifiable unless the divorce decree states otherwise. If your financial circumstances or your former spouse’s situation changes significantly after the divorce, you may be eligible to request a modification or termination of the support order.

A change in circumstances might include:

Our Des Moines family law attorney helps clients seek modifications when justified and defends against unfair or unsupported modification requests. We also help enforce spousal support payments if they are not made as ordered.

Spousal support is not meant to punish one spouse or act as a financial windfall for the other—it’s designed to address real financial disparities at the time of divorce. If your spouse requests more support than is reasonable or claims they cannot work when they can, we will help you respond with evidence and legal arguments that protect your rights and long-term financial well-being.

Common defenses against excessive support claims include:

We work with financial experts, review documentation, and craft a thorough legal strategy to ensure that any support awarded is fair and realistic.

Spousal support orders issued before January 1, 2019, follow previous federal tax rules, where payments were tax-deductible for the paying spouse and taxable income for the receiving spouse.

However, the Tax Cuts and Jobs Act changed the law for spousal support orders entered on or after January 1, 2019.

Under current federal rules:

These changes can significantly impact how support amounts are negotiated or litigated. We will help you factor in tax consequences during your support discussions so the financial implications don’t catch you off guard.

While courts will intervene when spouses cannot agree, many divorcing couples successfully negotiate spousal support terms as part of a broader divorce settlement. These agreements can provide flexibility, privacy, and greater control over the outcome than court-imposed decisions.

We help clients:

Even if you and your spouse are working cooperatively, it’s essential to have an attorney review any agreement before you sign. Once finalized by the court, the terms are binding.

Whether seeking support, responding to a request, modifying an order, or enforcing unpaid payments, having an experienced attorney can protect your financial future and ensure the outcome is lawful and fair.

At Feitelson Law Firm, our spousal support services include:

We are committed to giving clients personal attention, strategic guidance, and honest answers. You deserve a clear understanding of your rights and obligations—and a legal plan built around your goals.

Spousal support can impact your financial life for years to come. Don’t leave it to chance or guesswork. Whether you’re requesting support or being asked to provide it, Feitelson Law Firm is here to provide straightforward, experienced legal guidance every step of the way.

Contact our Des Moines spousal support attorney today to schedule a consultation. Together, we’ll assess your situation, outline your options, and create a legal path that protects your stability, dignity, and financial future.

Iowa law does not specify a minimum marriage duration to qualify for spousal support. However, the length of the marriage is a critical factor the court considers when determining whether to award support and its duration. Short marriages (typically under five years) rarely result in long-term support unless exceptional circumstances exist, such as one spouse giving up a career for the marriage.

Marriages lasting 10–20 years may qualify for rehabilitative or transitional support, while those over 20 years often result in longer-term or permanent arrangements. Courts assess duration alongside other factors, including financial dependency, age, and earning capacity. At Feitelson Law Firm, we help clients understand how the length of their marriage may impact spousal support outcomes.

Yes. Filing for divorce in Iowa does not disqualify you from receiving spousal support. Iowa is a no-fault divorce state, meaning the focus is on the irretrievable breakdown of the marriage rather than who filed. Spousal support decisions are based on financial need, earning potential, and the factors listed in Iowa Code § 598.21A, not on which spouse initiated the proceedings. Whether you or your spouse filed, you may still be eligible for support if you demonstrate financial need. Courts evaluate economic circumstances and contributions made during the marriage.

In most cases, spousal support ends when the paying spouse dies, unless the divorce decree includes provisions for continued support from the estate. If not addressed in the agreement, support typically terminates. If the paying spouse becomes disabled, they can petition the court for a modification based on changed circumstances. At Feitelson Law Firm, we help clients address these scenarios through careful drafting of support agreements.

Yes. Iowa courts can award temporary spousal support, also known as temporary maintenance, during divorce proceedings through a motion for temporary orders. This support helps maintain financial stability and may cover living expenses, legal fees, or other essential needs. To qualify, you must show immediate financial need and your spouse’s ability to pay. While similar factors are considered as in permanent support, the focus is on maintaining the status quo until the divorce is finalized.

Concealing assets or income is a serious matter under Iowa law. If asset hiding is suspected, we can initiate financial discovery to request tax returns, bank records, business documents, and conduct sworn depositions. Courts may order forensic accounting, appoint receivers, or impose sanctions for nondisclosure. Tactics like underreporting income, transferring assets, or creating fictitious debts can trigger court intervention.

When concealment is proven, courts may impute income, hold the spouse in contempt, or revise support based on uncovered assets. Post-divorce, courts allow post-judgment discovery to pursue hidden assets. Feitelson Law Firm works with financial professionals to uncover concealed income and pursue fair support.

Yes, you may waive spousal support in Iowa through a written agreement, typically in a prenuptial, postnuptial, or divorce settlement. These waivers are generally permanent once approved by the court. You usually cannot later request support, even if your circumstances change significantly.

However, courts may invalidate waivers signed under duress, fraud, or without adequate disclosure or legal counsel. Some agreements include limited waivers that preserve rights under specific situations. It’s essential to fully understand the implications before waiving support. Feitelson Law Firm provides comprehensive counsel on the consequences of waiving spousal support.

Spousal support involving business owners can be complex. Iowa courts examine actual versus reported income, personal expenses paid through the business, and the business’s fair market value. Courts may impute income when business owners reduce their salary or inflate expenses to lower their support obligation.

If the business was built during the marriage, its value and both spouses’ contributions may impact support and property division. Forensic accounting and cash-flow analysis are often necessary to determine the business’s true financial picture.

© 2026 Feitelson Law Firm All Rights Reserved. | Privacy Policy | Disclaimer | Sitemap